How to Know if a Loyalty Program Will Work for Your Business

Jan 11, 2026

The internet is full of advice on how to set up loyalty programs. What's harder to find is guidance on whether you should set one up in the first place.

The statistics make loyalty programs sound universally beneficial:

Small increases in customer retention can dramatically boost profits

Existing customers spend significantly more than new ones

Retention is far more cost-effective than acquisition

These numbers are real. But they don't mean a loyalty program is right for every business in every situation.

Before investing time and money, you need to honestly assess whether a loyalty program makes sense for your specific business. This article walks through the key questions to ask—and helps you determine if a program would genuinely benefit you.

Question 1: Do Your Products or Services Have Repeat Purchasability?

This is the fundamental question. Loyalty programs reward repeat behaviour. If your customers don't naturally return—or return very infrequently—a program has limited impact.

The Repeat Purchasability Spectrum

Think of businesses on a spectrum:

High repeat purchasability:

Cafés and coffee shops (daily or weekly visits)

Hair salons and barbershops (every few weeks)

Nail salons (every 2-4 weeks)

Restaurants (weekly or monthly)

Car washes (monthly)

Gyms and fitness studios (ongoing)

Pet groomers (regular maintenance)

These businesses see the same faces regularly. Customers develop habits and preferences. Finding a place they like means returning consistently. Loyalty programs thrive here because the natural behaviour pattern already exists—the program simply reinforces and rewards it. Gyms in particular benefit from programs that combat the ghost member problem—where two-thirds of memberships go unused—by using loyalty programs to reduce gym churn and keep members actively engaged rather than silently drifting toward cancellation.

Moderate repeat purchasability:

Clothing retailers (seasonal or occasional)

Bookshops (ongoing but less frequent)

Homewares and décor (project-based)

Pharmacies (regular but variable)

Veterinarians (routine care plus emergencies)

Electronics retailers (upgrade cycles)

Hotels (business travel, seasonal holidays)

These businesses see repeat customers, but less frequently. People might return a few times per year rather than weekly. Loyalty programs can still work here, but the structure matters more—thresholds need to account for longer intervals between visits.

Low repeat purchasability:

Car dealerships (years between purchases)

Furniture stores (infrequent major purchases)

Wedding services (once per customer, ideally)

Real estate agents (rare transactions)

Major appliance retailers (replacement cycles)

These businesses have long gaps between purchases. Traditional loyalty programs make less sense—customers won't accumulate meaningful progress between their rare transactions. Other strategies (referral programs, exceptional service that generates word-of-mouth) often work better.

Where Does Your Business Fall?

Be honest about your natural repeat rate:

Do customers typically come back within weeks or months?

Do they purchase similar items/services repeatedly?

Is there a maintenance cycle that drives regular visits?

Do you have variety that brings customers back for different products?

If you're in the high or moderate tiers, a loyalty program is likely worth exploring. If you're in the low tier, other customer relationship strategies might serve you better.

The Variety Factor

Even if individual products aren't repeat purchases, variety can create repeat customers. A sporting goods store might not see customers buying the same football repeatedly—but runners, cyclists, and gym-goers return for different needs throughout the year. The relationship is repeat even if specific purchases aren't.

Consider whether your product range creates reasons for ongoing visits, even if each visit involves different items.

Question 2: Are Your Margins Healthy Enough?

Loyalty programs have costs: platform fees, reward costs, and staff time. These costs need to be sustainable within your business model.

The Margin Reality Check

Businesses operating on very thin margins may find that reward costs squeeze already-tight profitability. If giving away every 10th product eliminates your profit on the previous nine, the maths doesn't work.

Generally speaking:

Businesses with healthy margins (10%+ net profit) can typically sustain loyalty programs comfortably

Businesses with moderate margins need to design carefully—thresholds and reward v Even businesses with tighter budgets have options—building a loyalty program on a limited budget often means choosing simpler reward structures and lower-cost digital platforms rather than abandoning the idea entirely.alues matter more

Businesses with very thin margins should calculate precisely before committing

Calculating Reward Costs

A simple framework:

If your reward is "Buy 9, Get 1 Free":

You're giving away approximately 10% of purchases to loyalty members

If members represent 50% of your customers, that's 5% of total revenue in rewards

Your margins need to absorb this while still generating profit

The offset: Loyalty members typically generate additional revenue through:

Increased visit frequency (they come back more often)

Higher per-visit spending (they feel connected, spend more freely)

Referrals (they recommend you to others)

Reduced marketing costs (retention is cheaper than acquisition) Running the real profitability math on loyalty programs before launch—factoring in both reward costs and the incremental revenue from increased frequency and spend—separates the 40-60% of programs that generate strong returns from those that quietly destroy value.

For most businesses with reasonable margins, these offsets more than compensate for reward costs. But if you're already struggling with profitability, adding reward costs might not be the right move.

Platform Costs Have Dropped

Modern digital loyalty platforms have made programs far more accessible. What once required expensive custom development now costs £15-50 per month. Perkstar starts at £15/month—a cost most businesses can easily justify if the program drives even one or two additional visits per month.

The cost barrier that once limited loyalty programs to large businesses has largely disappeared. The question now is primarily about reward structure and margin impact.

Question 3: What Are Your Competitors Doing?

Competitive analysis provides valuable insight—but requires interpretation, not just imitation.

If Competitors Have Programs

When competitors run loyalty programs, you face a decision:

The risk of not participating: Customers who value loyalty rewards may prefer competitors who offer them. You might lose customers to businesses that make them feel more appreciated.

The opportunity: A well-designed program can differentiate you. Better rewards, easier earning, more convenient digital experience—these can become competitive advantages.

What to research:

What structures do competitors use? (Stamps, points, tiers)

What rewards do they offer?

How easy is it to earn and redeem?

Are customers actually engaged, or do programs seem neglected?

What do reviews mention about their programs?

Understanding competitor programs helps you design something that stands out rather than blends in.

If Competitors Don't Have Programs

Two possible interpretations:

They've tried and failed: The industry or local market might not respond well to loyalty programs. This is worth investigating—but could also mean they executed poorly rather than that programs don't work.

They haven't caught on yet: You might have an opportunity to lead. Being the first business in your area offering a modern digital loyalty program can attract customers who appreciate the innovation.

How to assess: Talk to customers. Would they value a loyalty program? Have they wished you offered one? Customer feedback reveals more than competitor analysis.

The Differentiation Opportunity

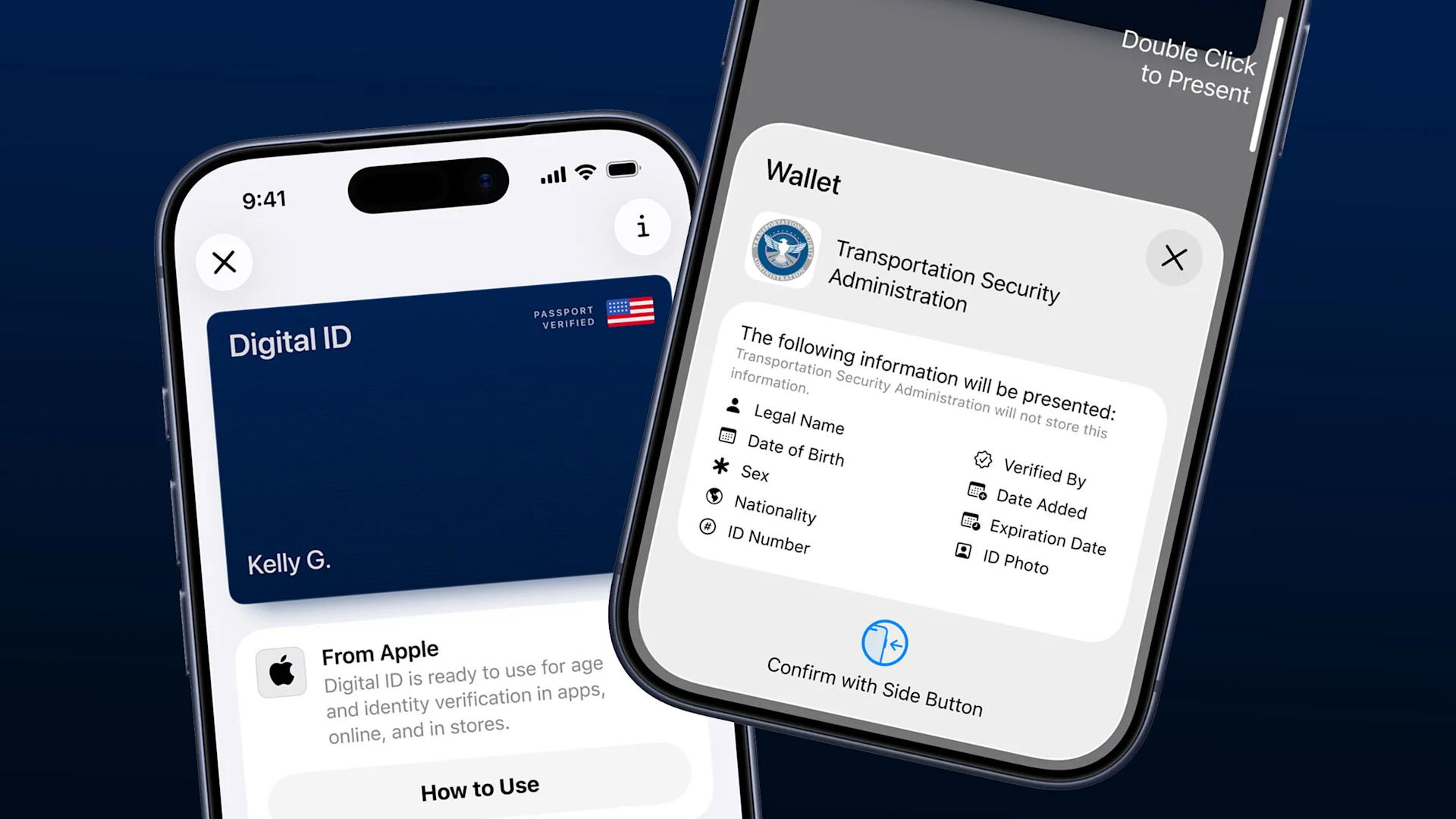

If competitors have basic paper punch cards, a modern digital program with wallet integration and push notifications creates meaningful differentiation. If they have complicated apps requiring downloads, a frictionless wallet-based program stands out.

Perkstar's wallet integration (cards save directly to Apple Wallet and Google Wallet) represents this kind of differentiation—modern convenience that many competitors haven't adopted.

Choosing the Right Program Structure

If you've determined a loyalty program makes sense, the next question is structure. Different models serve different goals.

Stamp/Visit-Based Programs

How it works: Customers earn a stamp or punch with each visit/purchase. After a set number, they receive a reward.

Best for: Businesses where visit frequency matters most. Cafés, salons, car washes, restaurants—anywhere you want customers returning regularly.

The goal: Increase frequency of visits.

The logic: Every visit earns progress, regardless of transaction size. A customer buying a £3 coffee makes the same progress as one buying a £12 lunch. This works when all transactions are roughly similar or when visit frequency is the primary goal. Starbucks built the most successful version of this model—over 30 million active members generating more than half the company's revenue—and the core mechanics behind a Starbucks-style rewards program are surprisingly replicable for small businesses using modern digital platforms.

Example: "Every 10th coffee is free" works perfectly for a café where most transactions are similar.

Spend-Based/Points Programs

How it works: Customers earn points proportional to spending. Higher spending earns faster progress toward rewards.

Best for: Businesses with varied transaction sizes where rewarding proportionally to spending makes sense.

The goal: Increase average transaction value.

The logic: A customer spending £100 earns more than one spending £10. This rewards your highest spenders more generously and encourages larger purchases.

Example: "Earn 1 point per £1 spent, redeem 100 points for £10 off" rewards proportionally to spending.

Paid Membership Programs

How it works: Customers pay an upfront fee for ongoing benefits—discounts, exclusive access, priority service.

Best for: Businesses with highly engaged customers willing to commit, particularly those with ongoing service relationships.

The goal: Create commitment and predictable value exchange.

The logic: The upfront payment creates psychological commitment (customers want to "get their money's worth") while providing you with predictable revenue.

Example: "VIP membership: £5/month for 15% off all services and priority booking" works for businesses with highly loyal clientele.

Which Structure Fits Your Business?

Choose stamps if:

Transactions are relatively consistent in value

Visit frequency is your primary goal

Simplicity matters (customers understand instantly)

Your business is high-frequency (cafés, salons, quick service)

Choose points if:

Transaction values vary significantly

You want to reward proportionally to spending

You have mixed products at different price points

Average transaction value is a key metric

Choose membership if:

You have a core group of highly engaged customers

Ongoing service relationships exist

You can provide genuine ongoing value

Customers would benefit from predictable benefits

Perkstar offers all three structures—stamps, points, and memberships—so you can choose what fits your business or even run multiple card types for different purposes.

Industries That Particularly Benefit

While the questions above apply universally, some industries have natural alignment with loyalty programs:

Food and beverage: High frequency, habitual behaviour, consistent transactions. Stamp cards work perfectly.

Beauty and personal care: Regular maintenance cycles, relationship-based service, opportunity for upselling. Great fit for stamps or memberships. The combination of regular maintenance cycles, emotional connection to results, and natural upselling opportunities makes loyalty programs in the beauty industry some of the highest-performing across any sector.

Retail with repeat potential: Consumables, fashion, hobby supplies. Points often work well for varied transactions.

Health and wellness: Regular visit patterns, membership models, community building. Multiple structures can work. Beyond these categories, there are industries where loyalty programs thrive that you might not immediately consider—from vape shops with consumable product cycles to tanning salons with seasonal demand patterns.

Professional services: When ongoing relationships exist, memberships or points can strengthen retention.

Hospitality: Hotels with business travellers, restaurants with regular diners. Points or stamps depending on model.

Signs a Loyalty Program Would Work for You

Strong indicators:

Customers already return naturally (you'd be rewarding and accelerating existing behaviour)

Competitors have programs (market expectation exists)

Your margins can absorb reward costs

You have a way to communicate with customers (email, phone, in-person)

Customers have expressed interest in rewards

You want to build deeper relationships, not just transactions One diagnostic that cuts through the noise: pull your transaction data and calculate what percentage of customers bought exactly once in the past year—if that number is above 50%, you're likely looking at one of the clearest signs your business needs a loyalty program.

Caution signs:

Very low natural repeat rate

Extremely thin margins

Competitors tried and clearly failed

No practical way to implement or communicate

You'd be forcing behaviour that doesn't naturally exist

Making the Decision

A loyalty program isn't right for every business—but for many, it's an effective tool for building customer relationships and driving repeat business.

If your assessment suggests a program makes sense:

Choose the right structure for your goals

Design rewards that are achievable and desirable

Select a platform that's simple to manage

Plan your launch and promotion

Track results and adjust as needed

Perkstar's 14-day free trial lets you build and test a program with real customers before committing. If it works, continue. If it doesn't fit, you've learned something valuable without significant investment.

Start your free trial at Perkstar →

If your assessment suggests caution:

That's valuable insight too. Not every business needs a loyalty program. Focus on what does drive your customer relationships—exceptional service, word-of-mouth, referral incentives, or other strategies that match your specific situation.

The goal isn't having a loyalty program. The goal is keeping customers coming back. Programs are one tool among many.