6 Ways to Measure Your Customer Loyalty Rates

Feb 7, 2025

You've launched a loyalty program. Customers are signing up. Stamps are being earned. But is it actually working?

Many businesses invest in loyalty programs without ever measuring whether they're achieving anything. They assume that signups equal success, that participation means loyalty, that having a program is enough.

It's not.

A loyalty program is an investment—of time, money, and effort. Like any investment, it should deliver measurable returns. And the only way to know whether you're getting those returns is to track the right metrics.

But here's the challenge: "loyalty" isn't one thing. Different businesses want different outcomes. Some want customers to visit more frequently. Others want larger transaction values. Some want deeper engagement. Others want longer customer lifespans. Each goal requires different metrics to measure success.

This article covers six ways to measure customer loyalty—each revealing something different about how your program is performing and where improvements might be needed.

Before You Measure: Define Your Goals

Metrics only matter in context. Before diving into calculations, clarify what you're actually trying to achieve:

Frequency: Do you want customers to visit more often?

Transaction value: Do you want customers to spend more per visit?

Retention: Do you want customers to stay with you longer?

Engagement: Do you want customers actively participating in your program?

Advocacy: Do you want customers recommending you to others?

Different goals require different measurements. A program that succeeds at increasing frequency might fail at increasing transaction value—and that's fine, if frequency was your goal. Understanding why customer loyalty matters at a strategic level—not just as a program checkbox—helps you choose the right goals from the start and avoid measuring metrics that don't align with your business reality. Problems arise when you're measuring the wrong things, or not measuring at all.

With goals clarified, let's explore six metrics that reveal how your loyalty program is actually performing.

1. Customer Retention Rate (CRR)

Customer Retention Rate measures how well you're keeping customers over time—not just acquiring new ones.

The Formula

(Current customers − New customers acquired) ÷ Customers at start of period = CRR

Example:

You currently have 500 customers

You acquired 150 new customers in the last 6 months

You had 400 customers 6 months ago

(500 − 150) ÷ 400 = 350 ÷ 400 = 87.5% retention rate

What This Reveals

A high retention rate means you're keeping most of the customers you acquire. A low retention rate means customers are churning—coming in and leaving quickly.

If your retention rate is low despite having a loyalty program, something's broken. Either:

The program isn't compelling enough to create loyalty

The core experience (product, service) is disappointing

Competitors are pulling customers away

You're not communicating with members enough to maintain connection

Benchmarks

Retention rates vary by industry, but generally:

Below 70%: Significant churn problem

70-85%: Room for improvement

Above 85%: Strong retention

Improving This Metric

Focus on what happens after the first purchase. Are you following up? Are you giving reasons to return? Are you communicating value? For cafés specifically, the structure of your stamp card—how many stamps, what reward, how it's promoted—directly determines whether customers hit that critical second and third visit, making stamp card design for your café one of the highest-leverage retention decisions you can make.

A loyalty program addresses this directly—but only if customers know about it, join it, and find value in participating. Push notifications keeping your business top-of-mind, birthday rewards creating emotional connection, progress updates motivating return visits—these features improve retention.

2. Redemption Rate (RR)

Redemption Rate measures how often customers actually claim the rewards they've earned.

The Formula

Rewards redeemed ÷ Rewards earned = Redemption Rate

For stamp-based programs: Completed cards ÷ Total stamps issued (divided by stamps required per card)

Example:

200 free coffees redeemed this year

2,500 total stamps issued

10 stamps required per free coffee (250 potential rewards)

200 ÷ 250 = 80% redemption rate

What This Reveals

Low redemption rates signal problems:

Rewards aren't appealing: Customers don't care enough about the reward to bother claiming it.

Thresholds are too high: Customers give up before reaching the reward.

Communication is failing: Customers don't know they've earned something or forget about the program.

Program is confusing: Customers don't understand how to redeem.

Surprisingly, industry-wide redemption rates for traditional loyalty programs often hover below 20%. Industries with consumable products and frequent purchase cycles—like vape shops, where customers buy e-liquid weekly—tend to have naturally higher redemption potential, but only if the program is structured to match those buying patterns, which is why digital loyalty cards for vape shops often outperform generic reward schemes. Digital programs with proper communication typically perform much better.

Benchmarks

Below 30%: Serious engagement problem

30-60%: Average performance

Above 60%: Strong engagement

Improving This Metric

Make rewards desirable: Are you offering what customers actually want?

Set achievable thresholds: Can typical customers realistically earn rewards?

Communicate progress: Remind customers when they're close to redeeming.

Simplify redemption: Make claiming rewards effortless.

Perkstar's push notifications are particularly valuable here. Sending "You're just 2 stamps away from a free coffee!" drives completions. Progress visibility in wallet cards keeps rewards top-of-mind.

3. Participation Rate (PR)

Participation Rate measures what proportion of your customers have actually joined your loyalty program.

The Formula

Loyalty program members ÷ Total customers = Participation Rate

Example:

800 loyalty program members

2,000 total customers

800 ÷ 2,000 = 40% participation rate

What This Reveals

A low participation rate means most customers aren't in your program at all. They're visiting, purchasing, but not enrolled—meaning you have no mechanism to track them, communicate with them, or systematically encourage their return.

Research suggests average consumers belong to numerous loyalty programs but only actively use a fraction. Getting them to join yours is the first hurdle.

Benchmarks

Below 30%: Enrollment problem

30-50%: Moderate enrollment

Above 50%: Strong enrollment

Improving This Metric

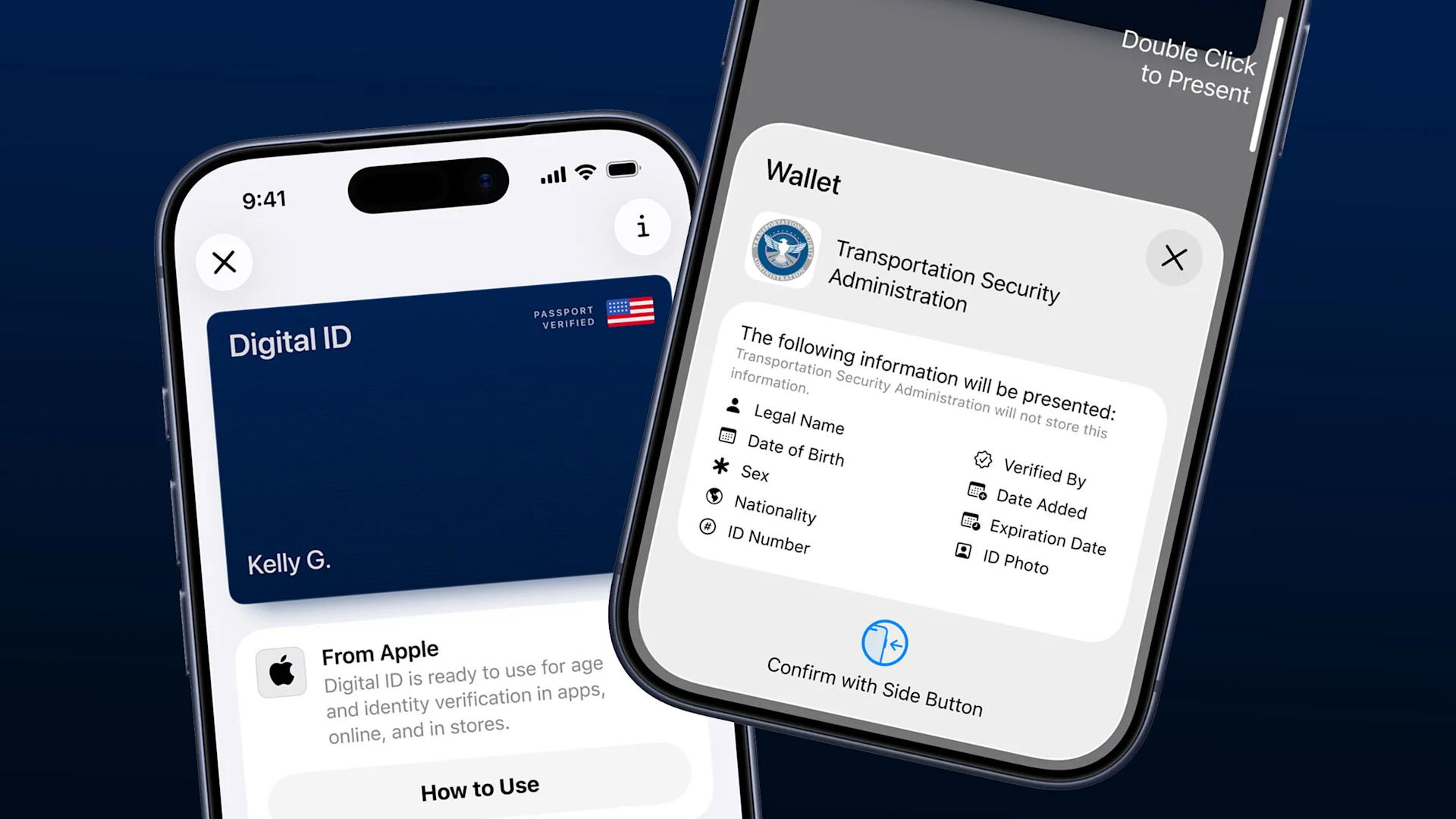

Reduce friction: How easy is signup? Perkstar's wallet integration (scan QR, save to phone) removes the barriers of app downloads and account creation.

Promote consistently: Is every customer asked? Are staff trained to mention it?

Offer immediate value: Sign-up rewards give reasons to join now rather than "maybe later."

Create visibility: Signage, counter displays, receipts—make the program impossible to miss.

If participation is low, you're leaving money on the table. Customers who would engage if enrolled are instead anonymous visitors you can't track or communicate with.

4. Repeat Purchase Rate (RPR)

Repeat Purchase Rate measures how many customers come back after their first purchase.

The Formula

Customers who made more than one purchase ÷ Total customers = Repeat Purchase Rate

(Usually measured over a 12-month period)

Example:

1,200 customers made more than one purchase this year

3,000 total customers this year

1,200 ÷ 3,000 = 40% repeat purchase rate

What This Reveals

This metric cuts to the core question: are people coming back?

A low repeat purchase rate might indicate:

Poor first experience

Weak value proposition

No reason to return specifically to you

Forgetting about you between potential visits

Competitors capturing subsequent purchases

Benchmarks

Varies significantly by industry:

Retail: 25-40% is typical

Cafés/restaurants: 35-50% is typical

Service businesses: 40-60% is typical

If your rate is below 20%, your loyalty program isn't doing its fundamental job.

Improving This Metric

The loyalty program itself should directly address repeat purchases—that's its primary purpose. But the program only works if people join and engage.

Focus on:

Getting first-time customers enrolled immediately

Following up after first purchase (welcome message, next-visit incentive)

Creating reasons to return (progress toward rewards, exclusive offers)

Staying top-of-mind between visits (push notifications, birthday rewards)

5. Loyal Customer Rate (LCR)

While Repeat Purchase Rate measures whether customers come back at all, Loyal Customer Rate measures how many become genuinely loyal—typically defined as purchasing four or more times per year.

The Formula

Customers with 4+ purchases ÷ Total unique customers = Loyal Customer Rate

(Usually measured over a 12-month period)

Example:

400 customers made 4+ purchases this year

3,000 total unique customers

400 ÷ 3,000 = 13.3% loyal customer rate

What This Reveals

This identifies your core base—the customers who are truly committed rather than occasional visitors. These are the customers who:

Generate disproportionate revenue

Cost least to serve (no acquisition cost)

Are most likely to recommend you

Are most forgiving when things go wrong

A low loyal customer rate means you're surviving on a stream of one-time or occasional visitors rather than building a foundation of regulars.

Benchmarks

Below 10%: Limited true loyalty

10-20%: Moderate loyalty base

Above 20%: Strong loyal customer foundation

Improving This Metric

Move customers from occasional to loyal through:

Recognition: Acknowledge frequent customers. Know their names, their orders, their preferences.

Escalating value: Make being loyal increasingly rewarding. Tiered benefits, milestone rewards, VIP treatment.

Emotional connection: Birthday rewards, surprise treats, community building.

Habit formation: Consistent experience, convenient locations/hours, rebooking encouragement.

Your loyalty program provides the structure for this progression—tracking visits, triggering rewards at milestones, enabling personalised communication.

6. Active Engagement Rate (AER)

Active Engagement Rate measures how many of your loyalty program members are actually using the program—not just signed up and dormant.

The Formula

Members who earned stamps/points in last 90 days ÷ Total members = Active Engagement Rate

(Timeframe varies by business type—90 days works for most)

Example:

500 members earned at least one stamp in the last 90 days

800 total members

500 ÷ 800 = 62.5% active engagement rate

What This Reveals

This is the reality check metric. You might have 1,000 members, but if only 200 are active, you effectively have a 200-person program with 800 dormant accounts.

Low active engagement indicates:

Rewards feel unattainable

Rewards aren't desirable

Communication has dropped o Understanding why customers abandon loyalty programs entirely—not just go dormant but actively disengage—helps you distinguish between a communication problem and a fundamental design flaw.ff

Customers forgot about the program

The experience didn't meet expectations

Benchmarks

Below 40%: Significant dormancy problem

40-60%: Moderate engagement

Above 60%: Strong active participation

Improving This Metric

Re-engagement campaigns: Reach out to dormant members with incentives to return. "We've missed you—here's a bonus stamp to welcome you back."

Progress reminders: "You're close to a reward!" messages motivate re-engagement.

Birthday and anniversary outreach: Annual touchpoints that reach even dormant members. Tanning salons, for example, have a natural advantage here—clients need regular sessions to maintain results—but converting that recurring need into active program engagement still requires deliberate strategy, from session-based milestone rewards to repeat customer strategies for tanning salons that tie loyalty progress to visible results.

Surprise rewards: Unexpected rewards for previously active members who've gone quiet.

Perkstar's lapsed customer campaigns automate this—set up once, and dormant members receive re-engagement messages automatically based on inactivity periods you define.

Putting Metrics Together: The Dashboard View

No single metric tells the whole story. Together, they reveal a complete picture:

Metric | What It Measures | Low Score Indicates |

|---|---|---|

Customer Retention Rate | Keeping customers over time | Churn problem |

Redemption Rate | Claiming earned rewards | Unappealing or unreachable rewards |

Participation Rate | Program enrollment | Signup friction or promotion failure |

Repeat Purchase Rate | Coming back at all | Weak value proposition or forgetting |

Loyal Customer Rate | Becoming truly loyal | Failure to deepen relationships |

Active Engagement Rate | Using the program | Dormancy and disengagement |

A healthy loyalty program shows:

High participation (most customers enrolled)

High active engagement (enrolled members using it)

High redemption (rewards being claimed)

High repeat purchase (customers returning)

Growing loyal customer base (deepening relationships)

Strong overall retention (keeping customers long-term)

Common problem patterns:

High participation, low engagement: People join but don't participate. Improve rewards, communication, and attainability. Ultimately, these metrics feed into the question that matters most: whether your loyalty program is actually profitable—generating more incremental revenue than it costs to operate. Restaurants, for instance, often discover that participation is strong but redemption lags—a pattern that the best loyalty apps for restaurants are specifically designed to address through automated reward reminders and simplified claiming processes.

High engagement, low redemption: People earn but don't claim. Improve reward appeal or simplify redemption process.

Good metrics, low retention: Program works but customers still leave. Look at core product/service issues beyond the loyalty program.

Tracking These Metrics

Digital loyalty platforms make tracking easier than paper ever could:

Automatic data capture: Every stamp earned, every reward redeemed, every member action is recorded.

Dashboard visibility: See key metrics at a glance without manual calculation.

Trend tracking: Monitor changes over time to see if improvements are working.

Segment analysis: Compare metrics for different customer groups. For businesses operating in markets where cost-of-living pressures have made every customer visit more deliberate—such as Australian small businesses focused on retention—this kind of data visibility is especially critical, because you can't afford to guess which strategies are working when margins are tight.

Perkstar's analytics dashboard provides visibility into program performance—member counts, activity levels, redemption patterns—without requiring manual tracking or complex spreadsheets.

Getting Started

Ready to measure (and improve) your customer loyalty?

Establish baselines: Calculate each metric for your current situation.

Set goals: What improvements would you consider success?

Identify weak spots: Which metrics need the most attention?

Take action: Implement changes targeting your weakest areas.

Track progress: Monitor metrics over time to see impact.

Perkstar's 14-day free trial gives you access to analytics alongside all program features—so you can start measuring from day one.

Start your free trial at Perkstar →

What gets measured gets managed. Start measuring your loyalty rates, and you'll finally know whether your program is working—and how to make it better.