Apple Just Put Your Passport in Your Phone. Your Loyalty Program Still Isn't There?

Nov 14, 2025

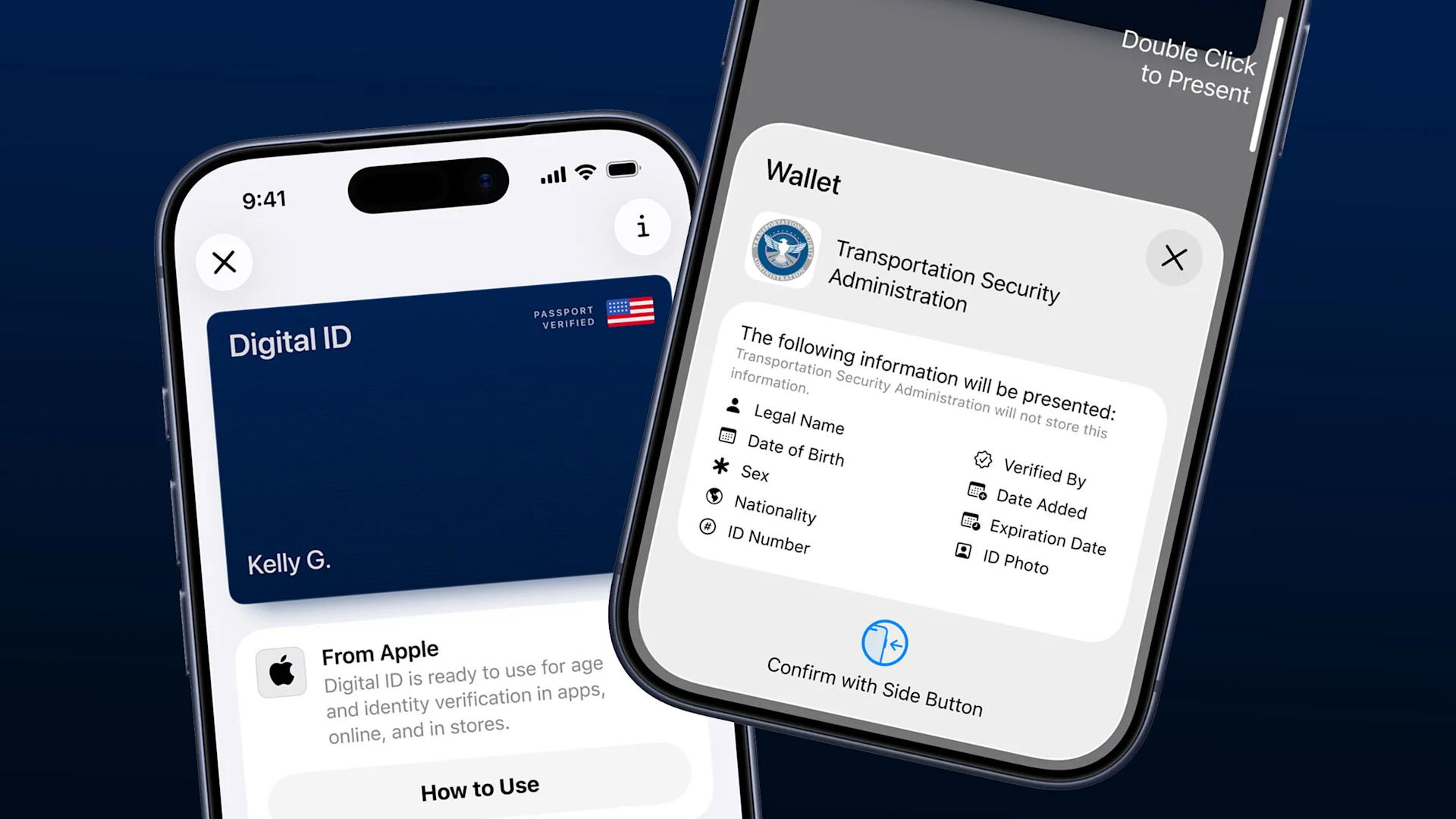

Yesterday, Apple did something remarkable: they launched Digital ID, allowing users to store their U.S. passport in Apple Wallet and use it at 250+ TSA checkpoints for domestic travel.

Let that sink in for a moment.

Apple—a company worth $3.5 trillion that doesn't do anything unless it's meticulously calculated—just convinced the U.S. government to let citizens replace their physical passports with a digital version living in Apple Wallet. The same wallet that holds credit cards, boarding passes, and event tickets.

This isn't just a convenience feature. This is Apple declaring that the physical wallet is dead, and Apple Wallet is the replacement.

And if you're running a loyalty program that requires customers to download a separate app, or worse, if you're still using physical punch cards, you just got left behind by about five years of consumer behavior evolution.

Why the Passport Announcement Changes Everything

Here's what most businesses are missing about this move:

Apple doesn't do experiments. When they add a feature to Wallet, it's because they've seen overwhelming evidence that consumers are ready to consolidate that category into their digital wallet.

They added credit cards in 2014. Now Apple Pay is accepted at 90% of U.S. retailers with over 11,000 banks supporting it.

They added boarding passes. Now most major airlines default to Wallet for mobile boarding.

They added car keys in 2021. Now 29 manufacturers and 300+ models support it.

They added hotel keys. Over 2 million keys provisioned across 65,000 hotel rooms.

They added transit passes. Now supported across 250+ regions and 800 cities globally.

And now they're adding government-issued identification—the most sensitive, regulated, and security-critical credential most people own.

This is Apple saying: "Everything important in your life will eventually live in Wallet. Get used to it."

The Consumer Behavior Shift You're Missing

Let me tell you what's happening in consumer psychology right now, and why it matters for your business:

People are actively reducing friction in their lives.

They don't want to carry physical wallets anymore. They don't want to download 47 different apps for 47 different businesses. They don't want to remember passwords, usernames, or which app has their loyalty card for your coffee shop.

They want consolidation. Everything in one place. One app to rule them all.

Apple Wallet is winning this consolidation battle. Not because it's the best technology (though it is very good), but because it's already there on every iPhone. Zero friction. Zero download required. Zero setup beyond tapping "Add to Wallet."

When Jennifer Bailey, Apple's VP of Apple Pay and Apple Wallet, announced this passport feature, she shared some eye-opening stats:

Apple Pay is now live in 89 markets worldwide

90% of U.S. retailers accept Apple Pay (up from 3% at launch)

Over 2 million hotel room keys provisioned

Transit supported in 800+ cities globally

This isn't a niche feature. This is mainstream consumer behavior.

And yet, I still walk into coffee shops, salons, and retail stores where the "loyalty program" is a separate app that 8 people downloaded, or a physical card that everyone loses.

You're competing for wallet space—digital or physical—against Apple's entire ecosystem. And you're losing.

What This Means for Loyalty Programs

Here's the brutal economic reality:

Every additional app you ask customers to download reduces adoption by 70-80%.

Let's say 100 customers are interested in your loyalty program:

100 would tap "Add to Wallet" (one tap, no download, instant)

20 would download a separate loyalty app (multiple steps, App Store friction, storage concerns)

You're leaving 80% of potential loyalty members on the table by not being in Apple Wallet. Even something as simple as a well-designed digital stamp card can hit 85-90% adoption when it lives in Wallet instead of requiring a separate download.

But it gets worse. Of those 20 who download your app:

30% never open it after the first time

50% delete it within 3 months

Most never enable push notifications

So your actual engaged loyalty base from 100 interested customers? Maybe 7-10 people.

With Apple Wallet integration? 85-90 engaged members from the same 100 customers.

This isn't theoretical. This is data from businesses that have run both standalone apps and Wallet-based loyalty programs.

The "But My Customers Don't Use Apple Wallet" Delusion

I hear this objection constantly: "My customers aren't tech-savvy. They don't use Apple Wallet."

Really? Let's test that theory.

Q: Do your customers pay with their iPhones?

If yes, they're using Apple Wallet. Apple Pay is Apple Wallet.

Q: Do your customers use mobile boarding passes at airports?

If yes, they're using Apple Wallet. That's where boarding passes default.

Q: Do your customers tap their phones for transit?

If yes, they're using Apple Wallet.

Your customers ARE using Apple Wallet. Multiple times per week. They just don't think about it because it's seamless.

What they're NOT doing is downloading your standalone loyalty app and remembering to open it every time they visit your business.

Why Apple's Passport Move Is the Final Validation

Let's talk about what it means that Apple convinced the U.S. government—not exactly known for rapid technology adoption—to accept digital passports.

It means the debate is over.

For years, there were legitimate questions about whether consumers would trust fully digital credentials. Would they feel comfortable not carrying physical backup? What about security? What about privacy?

Apple just got the U.S. government to answer all those questions with "Yes, we trust Apple Wallet for our citizens' most sensitive identification."

If the TSA trusts Apple Wallet with passport verification—a process that involves national security, identity fraud prevention, and international regulations—then your local customers should absolutely trust it with their coffee shop loyalty card.

The psychological barrier to adoption just got demolished.

The Three Types of Businesses (And Which One You Are)

In the wake of this announcement, every business falls into one of three categories:

Type 1: Still Using Physical Loyalty Cards

You're selling horse-drawn carriages in the age of autonomous vehicles.

Your customers lose your cards. You have zero data about who they are. You can't communicate with them. You're printing thousands of cards annually. You have no idea if your loyalty program even works.

You're not behind. You're functionally non-existent in the digital economy.

Type 2: Using Standalone Loyalty Apps

You're better than Type 1, but you're still fighting a losing battle.

You're asking customers to download an app they don't want, remember to use an app they rarely open, and keep an app they're actively trying to delete to free up storage space.

Your adoption rate is 10-20% of interested customers. Your engagement rate among downloaders is maybe 30%. Your actual active loyalty program participants? 3-6% of your customer base.

You've digitized a bad idea. You're a Fiat in a world of Porsches.

Type 3: Integrated With Apple Wallet (and Google Wallet)

You're where consumers are consolidating their digital lives.

One-tap enrollment. Zero downloads required. Can't be forgotten because it's always in their wallet. Push notifications that actually get seen. Geolocation triggers when customers are nearby.

Adoption rate: 85-90% of interested customers. Engagement rate: 70-80%. Actual active participants: 60-75% of your customer base.

You're not just running a loyalty program. You're building a customer retention system that works.

The Economics Are Undeniable

Let me show you what Apple Wallet integration is actually worth to a small business.

Scenario: Local coffee shop with 500 regular customers

With standalone app:

100 customers download app (20% adoption)

30 remain active users (70% attrition)

No direct communication with other 470 customers

Cost: £50-150/month for app platform

Incremental revenue: ~£2,000/year (from 30 active users)

Most café owners obsess over interior design and menu curation during launch but never build the retention systems that determine whether they survive past year one—a pattern visible in every café opening checklist that ignores post-launch economics.

With Apple Wallet loyalty (like Perkstar):

450 customers add to Wallet (90% adoption)

350 remain active (78% retention)

Push notifications reach all 450 instantly

Cost: £12-25/month

Incremental revenue: ~£18,000/year (from 350 active users)

Net difference: £16,000 annually from the same customer base, at lower cost.

This isn't speculative. This is data from actual businesses that switched from app-based to Wallet-based loyalty programs.

What Apple Is Teaching Consumers (And What You Should Learn From It)

Apple's Digital ID launch is a masterclass in how to train consumer behavior. Here's what they're teaching:

Lesson 1: Consolidation is inevitable

"Everything important belongs in one place. That place is Apple Wallet."

Lesson 2: Security through simplicity

"You're safer with everything in Wallet than scattered across 50 apps and physical cards."

Lesson 3: Friction is the enemy

"If it requires more than one tap, it's too complicated."

Every time Apple adds a new category to Wallet—credit cards, boarding passes, car keys, hotel keys, transit, IDs, and now passports—they're reinforcing these lessons.

And every time a business asks customers to download a separate app for loyalty, they're fighting against Apple's multi-billion-dollar effort to train consumers otherwise.

You will lose that fight. Not because your business isn't good. Because your distribution strategy is backwards.

The "But We're Not Big Enough" Excuse

Small businesses tell me all the time: "Apple Wallet integration is for big companies. We can't afford that."

Wrong. Spectacularly, expensively wrong.

Apple Wallet integration is MORE valuable for small businesses than large ones. Here's why:

Large businesses have brand recognition that drives app downloads. When Starbucks asks you to download their app, people do it because it's Starbucks.

Small businesses don't have that luxury. When "Joe's Coffee" asks customers to download an app, response rate is 5-10% at best.

But Apple Wallet doesn't care if you're Starbucks or Joe's Coffee. The adoption rate is the same because it's not about your brand—it's about Apple's infrastructure. An independent pet store with a loyalty program doesn't need Petco's marketing budget when every iPhone-carrying dog owner can add a rewards card in one tap while standing at the register. A tattoo studio loyalty program that lives in Apple Wallet can turn a one-session client into a lifetime collector who returns for sleeves, touch-ups, and new pieces—all without requiring them to remember your Instagram handle or dig through their email for a booking link.

Platforms like Perkstar offer Apple Wallet integration starting at £12/month. That's less than you spend on coffee in a week. That's less than printing physical loyalty cards costs over a year.

The technology is democratized. The only thing stopping you is the belief that it's "not for you."

It is for you. It's especially for you. Because you can't compete on brand recognition, you need to compete on distribution convenience.

What Happens If You Ignore This

Let me paint you a picture of what your business looks like in 18 months if you don't adapt:

Scenario: You're still using physical cards or a standalone app

Your competitor down the street implements Apple Wallet loyalty.

Their customers add cards with one tap. They get push notifications about promotions. The system automatically reminds them when they're nearby. It tracks churn and sends win-back offers automatically.

Your customers? Still losing physical cards. Still forgetting to bring them. Still not getting your promotions because you can't reach them.

Here's what happens:

Month 1-3: Their loyalty enrollment rate is 4-5x higher than yours.

Month 4-6: Their push notifications drive 15-20% more frequent visits.

Month 7-12: Their automated churn prevention saves 20+ at-risk customers you would have lost.

Month 13-18: They've built a database of 800 engaged loyalty members. This competitive dynamic isn't limited to retail—private clinics that implement Wallet-based patient loyalty programs see similar advantages in treatment plan completion rates over practices still relying on appointment reminder cards. You have 150.

Revenue gap: £40,000-60,000 annually.

Not because their coffee is better. Not because their service is superior. Because they're on the platform where customers are consolidating their digital lives, and you're not.

The Path Forward Is Obvious

Here's what you need to do:

Step 1: Accept reality

Apple Wallet is winning the consolidation war. Physical cards are dying. Standalone apps are friction. This isn't debatable anymore—the U.S. government just validated it by putting passports in Wallet.

Step 2: Choose a platform that integrates with Apple Wallet

Perkstar, for example, offers:

Native Apple Wallet and Google Wallet integration

One-tap customer enrollment (no downloads)

Push notifications that actually get read

Automated churn prevention with RFM tracking

Real analytics, not "simple stats"

Starting at £12/month

Step 3: Migrate your existing customers

Send one message: "We've upgraded to Apple Wallet! Add your loyalty card with one tap." Include a QR code. 80-90% will convert within two weeks.

Step 4: Stop fighting consumer behavior

You can't force customers to download your app. You can't make them remember physical cards. But you can meet them where they already are: in Apple Wallet, which they open 20+ times per day.

The Bottom Line: Distribution Beats Everything

You know what the most successful businesses in history have in common? They didn't have the best product. They had the best distribution.

McDonald's doesn't make the best burgers. They have the best real estate locations.

Amazon doesn't have the best selection. They have the best delivery infrastructure.

Facebook wasn't the best social network. They were on the platform (web browsers) where people already spent their time.

Apple Wallet is the distribution platform of the 2020s.

Your loyalty program can be perfectly designed, generously rewarded, and beautifully branded. If it's not on Apple Wallet, it's irrelevant to 80% of potential members.

Yesterday's passport announcement wasn't just about travel convenience. It was Apple's declaration that the physical wallet is obsolete, and businesses that haven't adapted are competing with a dead format.

Your loyalty program belongs where your customers' lives are consolidating: in Apple Wallet.

Everything else is just expensive friction pretending to be strategy.

Ready to stop fighting consumer behavior and start leveraging it? Visit Perkstar and set up Apple Wallet loyalty in under 30 minutes. Your customers are already there. Your loyalty program should be too.

Want to see how Apple Wallet integration transforms loyalty program adoption? Talk to your dedicated account manager about businesses that switched and saw 4-5x enrollment increases. The data doesn't lie.